EMPLOYEE RETENTION CREDIT

NOTE: IRS Income Tax Addback for the Employee Retention Credit

With tax return filing approaching for many clients, this is a reminder that IRS guidance provides that employers may not deduct wages that were used in the ERC calculation from taxable income up to the amount of the ERC. The IRS issued Notice 2021-49 N-2021-49 (irs.gov) indicating an employer who deducted wages that were also the basis of an ERC claim must adjust income in the year the wages were paid, not the year the law was enacted or the refund claim was filed or when the refund is/will be received. Therefore, if an employer files a refund claim for an ERC for a quarter in 2020, then according to the IRS the adjustment to taxable income equal to the ERC must also be included on its 2020 federal income tax return, even if that refund claim is filed in 2021 or later. According to the IRS guidance, amended returns will be necessary for businesses that didn’t include adjustments on their 2020 and/or 2021 income tax returns. Please consult your tax advisor for guidance on the required adjustments to taxable income and the timing of the adjustments due to this IRS Notice.

Since there is no ERC benefit for state tax purposes, generally there should not be a wage add-back when computing state income taxes. See for example, California guidance that the adjustment to income does not apply ERC refunds are not taxable income for California – Spidell (caltax.com). Please check with your tax advisor for your state tax treatment of the ERC wage adjustment.

We are available to provide refund details and/or participate in any discussions with you and your tax advisor.

The Employee Retention Credit (ERC) under the CARES Act is a refundable tax credit designed to encourage businesses to keep employees on their payroll. Each qualifying employee may produce up to $26,000 of business cash benefits, which can be monetized through federal employment tax with holdings.

Think LLP is the ERC expert and knows how to strategically apply funds across all stimulus programs to maximize your benefit. Keep reading to learn more or click here to schedule a complimentary consultation to discuss your company’s ERC eligibility.

INTRODUCTION

The Employee Retention Credit (ERC) is a federal government cash award available to virtually every small business in America. Generally your business will be entitled to $5,000 for every employee in 2020 and up to $21,000 per employee in 2021. You can qualify for the ERC even if you have received PPP I and PPP II. Food and Beverages companies can qualify for ERC even if awarded an additional Restaurant Revitalization Fund grant.

“Every client is served by an experienced credits and incentives professional with every project reviewed and approved by CPA’s and/or Attorneys.”

Brian Eby, Partner Attorney, MBA

ERC Team Leader

ERC...

Eligibility

Under the original law only operations that were either fully or partially suspended by a COVID-19 lockdown order; or, for any quarter in 2020, where there was a 50% reduction from 2019, were eligible.

In 2021, gross receipts test were made easier only a 20% reduction from 2019 needed to qualify.

Many companies that did not see a qualifying gross receipts reduction will qualify if “partially suspended” due to governmental orders that limit hours of operations, disrupt supply chains, restrict access to the workplace, limit gathering sizes or require slowdowns for cleaning, among other suspension scenarios.

Period of Availability

The original law only included qualified wages paid after March 12, 2020, and before Jan. 1, 2021. Now the ERC has been extended through September 30th, 2021.

Amount

Under the original law, the amount of the ERC was equal to 50% of the qualified wages paid to the employee, including the cost to continue providing health benefits to the employee. In 2021 the ERC amount is increased to 70% of qualified wages.

Under the original law ERC was capped $10,000 in qualified wages for all of 2020. In 2021, the qualified wages are $10,000 per quarter, or a maximum ERC of $21,000 for 2021. In all, employers could receive as much as $26,000 per employee for 2020 and 2021.

PAYROLL TAX EXPERTISE

This is the least understood and most under appreciated aspect of selecting your ERC advisor. Our experience with hundreds of clients will help you realize your ERC benefits quickly. Obtaining the benefits requires a payroll tax expertise that none of our competitors have. You must know how to handle payroll coding with all the payroll companies to actually obtain the ERC fully and accurately (within weeks or on your next payroll is no longer an option). Filing a 941X is likely to take up to a year or more to get processed and paid.

“From analysis to filing our team of experts will take on the heavy lifting and maximize your benefits.”

Krista Caulkins

Director

OUR PROCESS

PHASE 1

QUALIFICATION

- Qualified Employer

- Review Facts

- Government Orders

PHASE 2

QUANTIFICATION

- Collect Data

- PPP Loans and Use

- Quarterly Analysis

- Payroll

PHASE 3

FILING

- 941X – Quarterly

- Tracking Electronic Review Process IRS

- IRS Exam Support

(if audit)

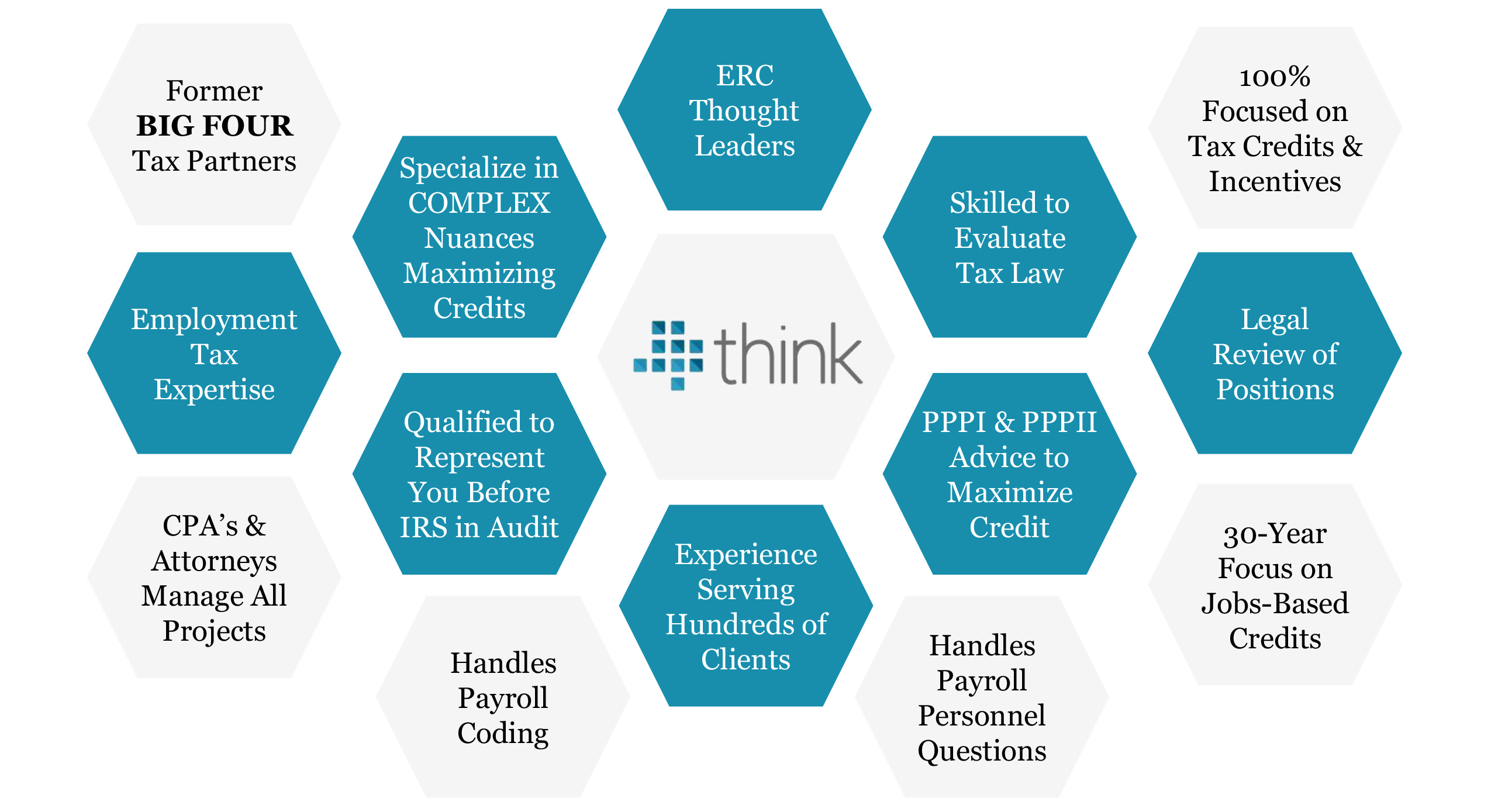

THINK ADVANTAGES

There has been a rush of overnight ERC service providers like PEOs, payroll processors, industry associations, overnight consultants or unqualified advisors. You might save some fees, but how much credit did you give up? Who will advise you on PPP I and II utilization to maximize your ERC? Who will evaluate and advise you how to allocate expenses to minimize use of your PPP for wages? Who will be there to defend you when the IRS audits your ERC? Who will respond to IRS correspondence? Who will handle the payroll coding and payroll personnel questions to be sure your deposits are handled correctly? Your ERC will be realized by retaining or recovering federal payroll taxes. Don’t trust a serious responsibility like payroll tax remittance to anyone who is not a CPA or an attorney. The process is just too complex and requires advisors with professional qualifications and tax credit experience to perform the analysis so that you obtain and can support the maximum award possible.

Our Team is led by eight former Big 4 Tax Partners, providing you with Big 4 quality and experience with the flexibility and cost advantages of a CPA firm specialized in nothing other than credits and incentives. Other advantages are:

THINK COMPARISON TO OTHER ERC SERVICE PROVIDERS

We provide the professional credentials and experience to evaluate your ERC calculation, applying the law in a way to maximize and defend your award under audit. We provide full life-cycle services from the computation of the ERC, realization of benefit through your payroll tax filing process, documentation of your ERC in a detailed tax credit study and IRS audit support which may be years down the road. We have nearly 30 years of experience working exclusively with employee-based jobs tax credit studies. No other ERC service provider provides the complete solution we offer through our team of Former Big 4 CPA’s and attorneys.

QUALIFICATION

You qualify if you had 1) quantitative comparison of gross receipts in 2020 & 2021 compared to 2019 OR 2) qualitative alternative test based on whether government orders impacted your operations fully or partially due to COVID-19.

If #2: Questions to Ask

- Did your employees have to socially distance at work?

- Did your customers have to socially distance in your business (e.g. tables separated 6 ft at restaurant)

- Were your business hours limited in some fashion?

- Cleaning periodically

- Opening/Closing time

- Limited hours to sell alcohol after a certain time

- Restricted from working in the facility?

- Were operations temporarily shut down?

- Were employees restricted from going to work?

- Were employees subject to a curfew that affected hours worked?

- Was your business to shut down for periodic cleaning and disinfecting?

- Did your venders create a supply chain disruption? (even if the employer was an essential business exempt from government orders)

- Did your service providers have disruption that created a supply chain disruption?

- Was there any limitation placed on working hours? (even if the employer was an essential business)

- Were there any government orders that affected the business in a way that it could not operate in a comparable manner?

- Was there any unbundled part of the business in a way that the business part could not operate in a comparable manner?

- Was there restricted access to the physical workplace?

- Was there reduced working hours because of pandemic-related operating limitations?

- Were any imposed limitations on the use of physical space, affecting services?

- Were any imposed limitations on size of gatherings, affecting the business operations?

(e.g. number of customers physically in the business) - Were your employees denied access to the use of physical workspace space or physical assets?

- Were your employees required to work remotely causing some limitations in ability to perform comparable duties?

This test highly subjective and requires a review of your specific circumstances to fully understand qualification and ERC eligibility.

Think, LLP’s management team is made up of “Big-4” accounting firm partners and consultants. We focus on providing credits and incentives services including ERC, state credits and incentives, R&D Tax credit studies and sales and use tax consulting and compliance services. Aligned with the client’s trusted business advisors, Think LLP’s studies are imperative for maximizing and sustaining significant tax savings.

Our services complement the expertise and expand the service offerings for advisors and CPA’s clients. Together we help strengthen existing and future client relationships.